Start small and build…BUILD…BUILD. This is how you manage debt, by building momentum against the rising tide.

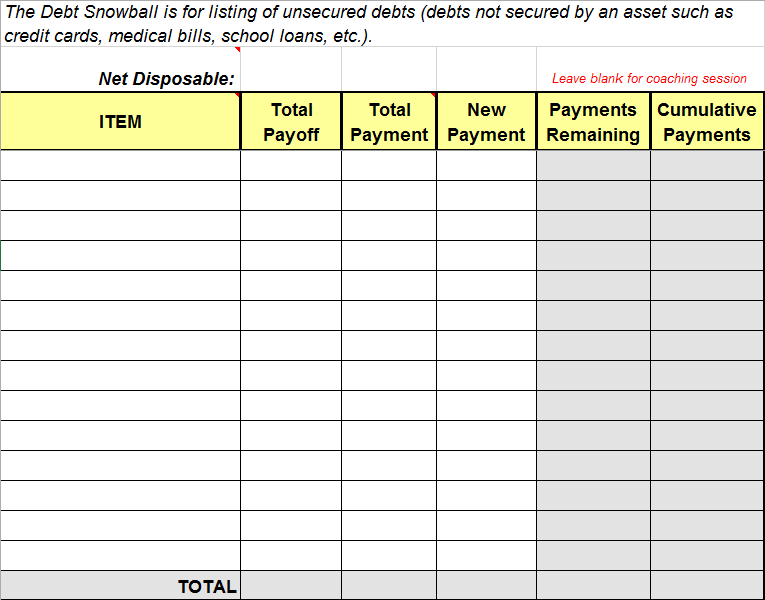

We use the Dave Ramsey tool of the Debt Snowball, one of our favorite financial solution services, to help you manage your debt, while at the same time sharing techniques for keeping creditors from hounding you. By going against the common wisdom of paying off the highest interest debt first, and instead building momentum by moving from small debts to large, you will see results more quickly. This will keep you motivated and will help you to believe, in your plan and in yourself.

Financial solution services

The Debt Snowball Plan…

- Save $1,000 for emergencies

- Stop retirement savings short-term

- Stop all payments except minimum payments

- Begin paying your smallest debt first

- Pay the next smallest debt second, and so on

- Quick results lead to renewed commitment

- Let the snowball roll and grow

Credit cards, student loans, house and car payments, medical bills, and the list goes on. If you have multiple debts and find yourself falling behind, we’ll help you create a debt repayment plan that makes the most sense for your situation. Stop the calls and the headaches.

Getting on the ball…

The simplest plans are usually the best. Dave Ramsey’s Debt Snowball is a simple plan to help you build momentum toward becoming debt free. By beginning with your smallest debt you begin to see results quickly. This results oriented approach to debt reduction is the most effective method for reducing debt we have found. In other words, we use it because it works.

Increase your Income…

Beyond the Debt Snowball plan, increasing your income to generate more cash flow is a great way to reduce debt. If you set aside this extra income for debt reduction only, you will be on the way to a debt-free life much more quickly.

- Get a second job – full or part-time, does not matter. This cash goes to debt only.

- Sell some things – use Craigslist and/or eBay to generate some cash to pay down your debt. Sell so much stuff the kids begin to wonder, “Are we next?”

- Get rid of non-essentials – beyond the basics of food, shelter, clothing, transportation, and utilities, it’s time get tough with yourselves and stop wasting cash.

- Cut up the credit cards – they will only cause you more pain and heartache. Besides, you now have a cash emergency fund, you don’t need no stinkin’ plastic.

Managing debt is not easy but it is actually easier than we make it seem. All it really takes is planning and commitment. We are here to help you with the planning and financial solution services; you must make the commitment.

Our finance coaching staff will help you outline, plan for, and achieve both. Contact us today to begin your journey to financial freedom and the peace of mind of a debt-free life.